Agence du revenu du Québec c Jenniss

The Court of Appeal of Québec released a decision on December 9, 2014 in <a href="http://www.canlii.org/en/qc/qcca/doc/2014/2014canlii83137/2014canlii83137.html" title="Agence du revenu du Quebec c. Jenniss">Agence du revenue du Québec c. Jenniss</a>, dismissing the appeal of Revenu Québec (RQ) against a Court of Québec judgment that cancelled tax assessments issued against the respondent, Marcelle Jenniss.

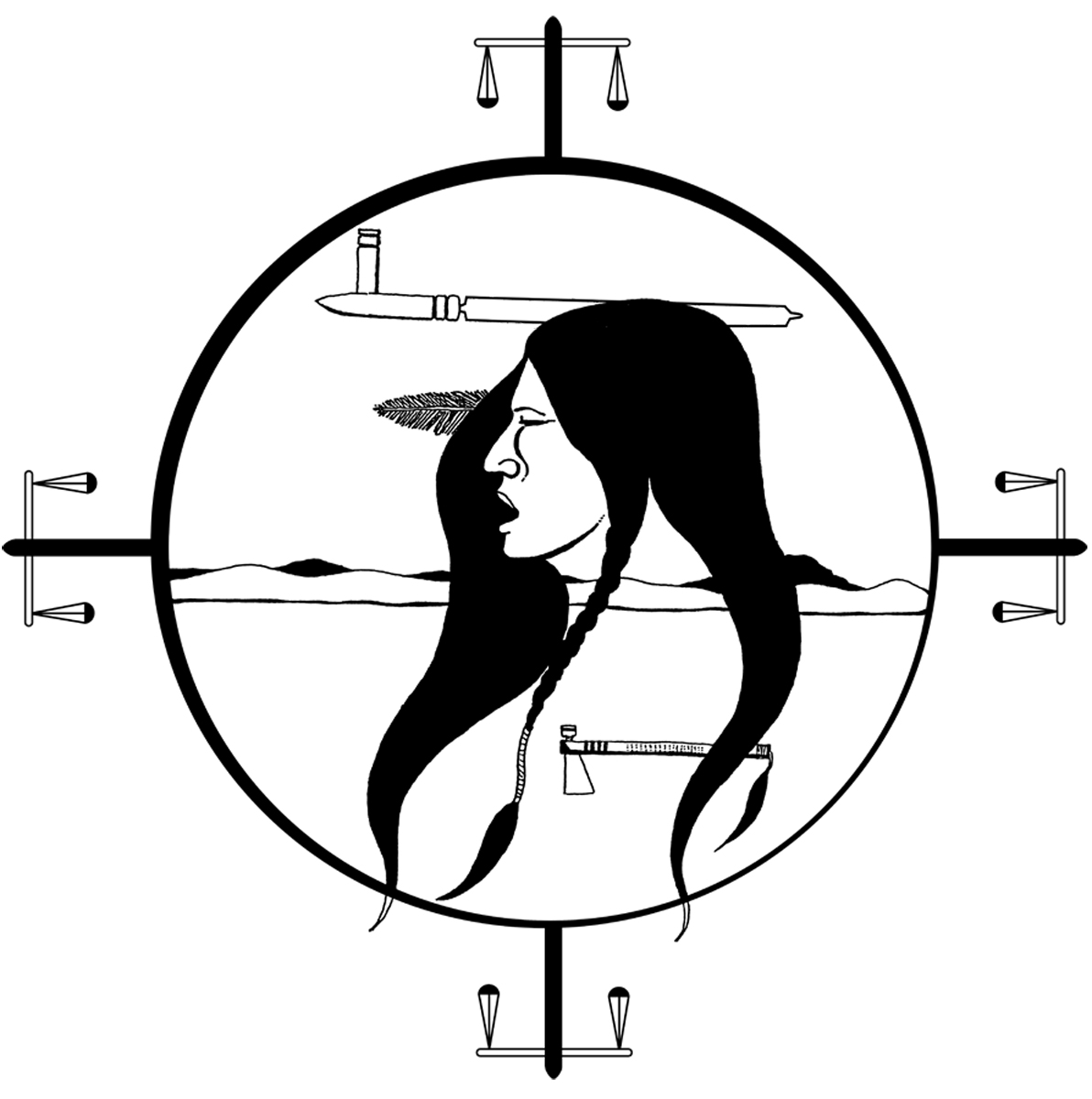

The dispute in this case centred on whether or not certain portions of the respondent's income were "situated on reserve" for the purposes of the Indian Act, which would determine whether she could benefit from tax exemption under s. 87 of the Indian Act with respect to these portions of her income. The respondent is a member of the Maliseet First Nation of Viger who has status under the Indian Act but does not live on reserve land. For the tax years of 2004, 2005 and 2006, the respondent received notices of tax assessment from RQ that required her to include money she had earned from her work on a fishing boat owned by the Maliseet Nation as part of her taxable income. The particular fishing boat that the respondent worked on during these years had been provided to the Maliseet Nation by the Department of Fisheries and Oceans (DFO), following the Supreme Court of Canada's clarification of a treaty right to catch and sell fish under the Peace and Friendship Treaties of 1760 and 1761 in its Marshall decision in 1999.

The Court of Québec held that the boat constituted personal property "[g]iven to the Indians or to a band under a treaty or argreement between a band and Her Majesty" under s. 90(1)(b) of the Indian Act because it was transferred to the Maliseet Nation through agreements that referenced the Marshall decision. The lower court held that these agreements constituted a way in which the parties had chosen to "update [the Treaties of 1760 and 1761] to today's reality" [translation] and "enable their realization" [translation]. Through the application of s. 90 of the Indian Act, the Court of Québec decided that the respondent's income earned from work on the boat was "situated on reserve" and she was entitled to deduct that employment income from her notices of assessment for the relevant tax years.

The appellant tried to challenge the lower court's factual determination that the fishing boat had been transferred to the Maliseet Nation by DFO in order to recognize and implement the spirit of the Treaties of 1760 and 1761. It argued that it had never been proven at trial that the Maliseet Nation was a party to the Treaties of 1760 and 1761 and that no historical evidence had been brought to support this claim. However, the Court of Appeal found that the appellant had failed to reproduce sufficient evidence in the record to challenge this issue on appeal. Furthermore, in spite of the thin record before the Court of Appeal, it found that there were a number of "serious indications" [translation] that the Maliseet Nation had been concretely involved in the Treaties of 1760 and 1761. The Court of Appeal pointed to references in the Marshall decision, to the transfer agreements between the Maliseet Nation and DFO at issue in the proceeding, and to the parliamentary debate on the relevant transfer agreements as all indicating that the Maliseet Nation had been a signatory to the Treaties. Although it had not been proven that this information was before the Court of Québec, the Court of Appeal determined that it could use this evidence based on the concept of "judicial knowledge" referenced in the Supreme Court of Canada's 1990 decision in R v Sioui.

The Court of Appeal held that the transfer agreements between the Maliseet Nation and DFO were "supplementary agreements", such as those referenced by the Supreme Court of Canada in its 1990 decision in Mitchell v Peguis Indian Band, fleshing out the details of the treaties that were otherwise couched in general terms. While the lower court had been careful not to suggest that transfer agreements constituted treaties in and of themselves, which would have attracted protection under s. 35(1) of the Constitution Act, 1982, the Court of Appeal found that it was implicit in the lower court's reasons that these agreements represented one of the means that had been chosen by the Crown to honourably fulfill its treaty obligations to First Nations. The Court of Appeal also rejected the appellant's argument that the commercial nature of the transfer agreements through which the boat was acquired rebutted the presumption that it was personal property situated on reserve under s. 90(1)(b). The Court of Appeal found no evidence to suggest that the boat's fishing activities for the Maliseet Nation went beyond the objective of providing a "moderate livelihood" to their members, as was their entitlement under the Treaties (as interpreted in the Marshall decisions). The Court of Appeal concluded that the lower court had correctly held that the boat should be deemed to be situated on the Maliseet Nation's reserve.

The Court of Appeal went on to apply the connecting factors test under s. 87 of the Indian Act. While the Court of Appeal noted that the application of this test largely fell within the trial judge's discretion, it came to the same conclusion that the respondent's income from working on the boat constituted personal property situated on reserve. The Court of Appeal found that the respondent's income from work on the boat was closely related to both her "Indian" status and the objective of the transfer agreements to provide her with a livelihood. The Court of Appeal also noted that the Maliseet Nation's only office was located on reserve and it was this office that managed the respondent's employment and administered her pay in relation to the boat. The Court of Appeal noted that while the respondent herself did not live on reserve, this factor was not applicable as the Maliseet Nation's members live scattered across Québec and elsewhere; the respondent's place of residence was not so much her choice as it was a reflection of the reality of the Maliseet Nation's membership, with virtually none of its members living on its reserve lands. The Court of Appeal also found that it would be illusory to think that a financial institution might establish itself on Maliseet reserve lands given that there were almost no members living on reserve.