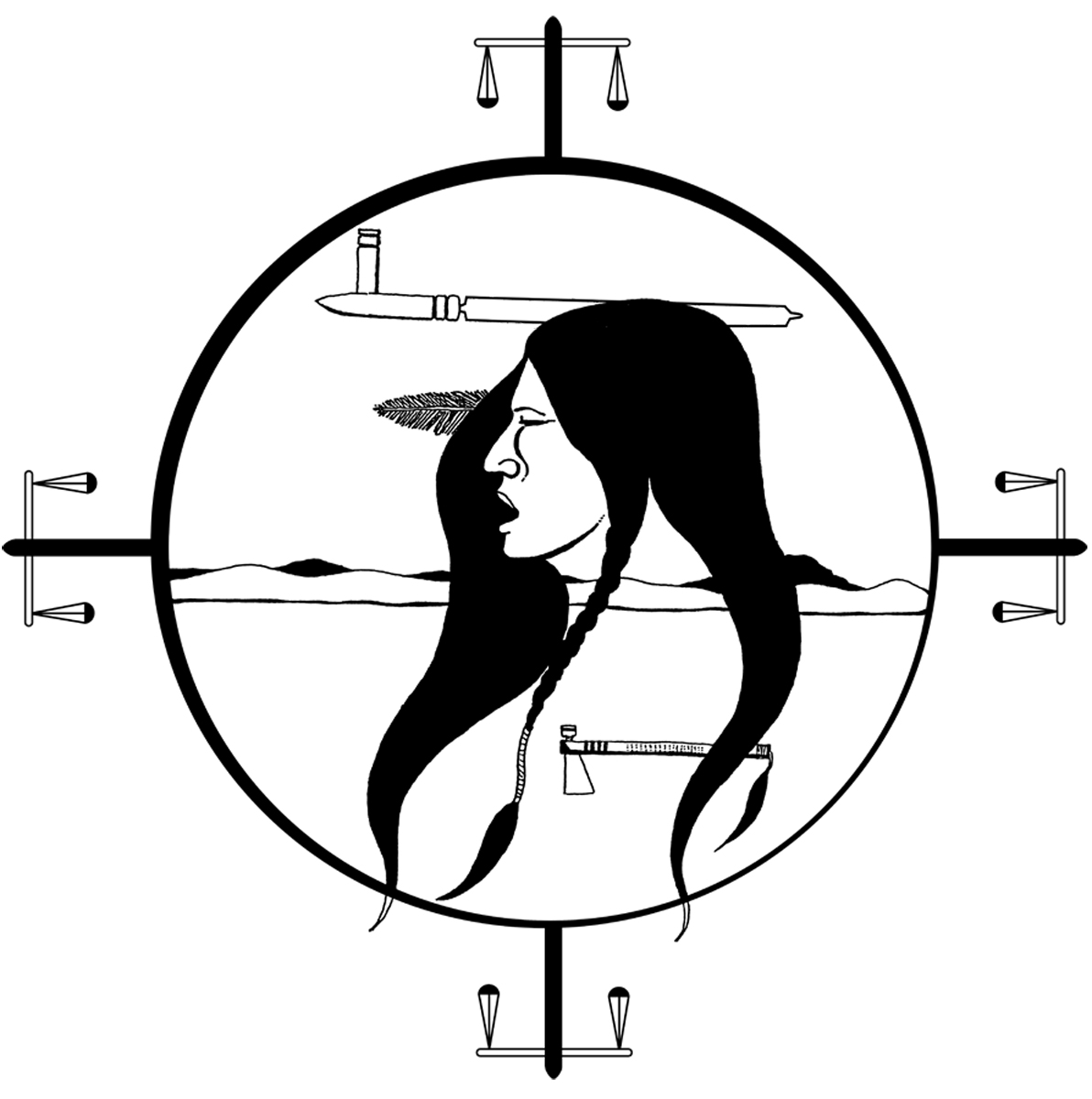

Baldwin v The Queen

The Tax Court of Canada released a decision on September 26, 2014 in <a href="http://www.canlii.org/en/ca/tcc/doc/2014/2014tcc284/2014tcc284.html" title="Baldwin v. The Queen"><em>Baldwin v. The Queen</em></a>, dismissing appeals from income tax assessments brought by five different individuals employed by a company called Native Leasing Services ("NLS").

NLS is a sole proprietorship owned by one Roger Obonsawin who is a member of the Odanak First Nation with status under the Indian Act and resides on the Six Nations Reserve. NLS provides human resource services and employment placement for Aboriginal not-for-profit organizations, referring to this relationship as the "leasing" of employees to what it refers to as "placement organizations". Although NLS had a small administrative staff that worked on the Six Nations Reserve its several hundred "leased employees" almost exclusively conducted work off reserve. The NLS also maintained its operating account at a CIBC bank branch on reserve in Hobbema, Alberta. Obonsawin was operating NLS and its key functions on reserve in part based on his understanding that on the strength of the 1983 Supreme Court of Canada Nowegijick decision the income of his "leased employees" would be exempt from income tax. The court, however, held that the governing test for the exemption of personal property from taxation set out in section 87 of the Indian Act is now that which was laid out by the Supreme Court of Canada in both the 1992 Williams decision and the more recent 2011 Bastien Estate decision - the so-called "connecting factors test". Applying this test, the court found that although some of the appellants did some of their work on reserve the focus of each of their various positions was off reserve and their employment income was therefore situated off reserve and properly assessed as being taxable.